Non-fungible tokens (NFTs) are digital assets that are based on the blockchain technology. An NFT can be any digital work – a video clip, animation, music, collectible cards, a domain name, a piece of writing, or recently even a full or shared ownership of physical assets such as buildings.

Measuring value: fungible vs non-fungible assets

We are used to measure value against fungible tokens, the most common of which are currencies – either fiat money like dollars, pounds or euro, which are issued by a central authority, or cryptocurrencies like Bitcoin, Ether, etc., which drive their value from the blockchain. In contrast, a non-fungible asset is something unique, having its own characteristics and value like, for example, a house, a painting or a song. It cannot be exchanged for something else.

There are also semi-fungible assets. Let’s take for instance an airplane ticket. A first-class ticket is considered by people more valuable than an economy-class one. Hence, it is not-fungible since it cannot be substituted for an economy-class ticket. Two first-class tickets, on the other hand, may be viewed as fungible because they are of equal value. Another such example is a coupon for a shop. If its value is $20, it can be swapped for any similar coupon, but once it is used, it no longer holds the same value and should not be regarded a token.

Digital ownership redefined

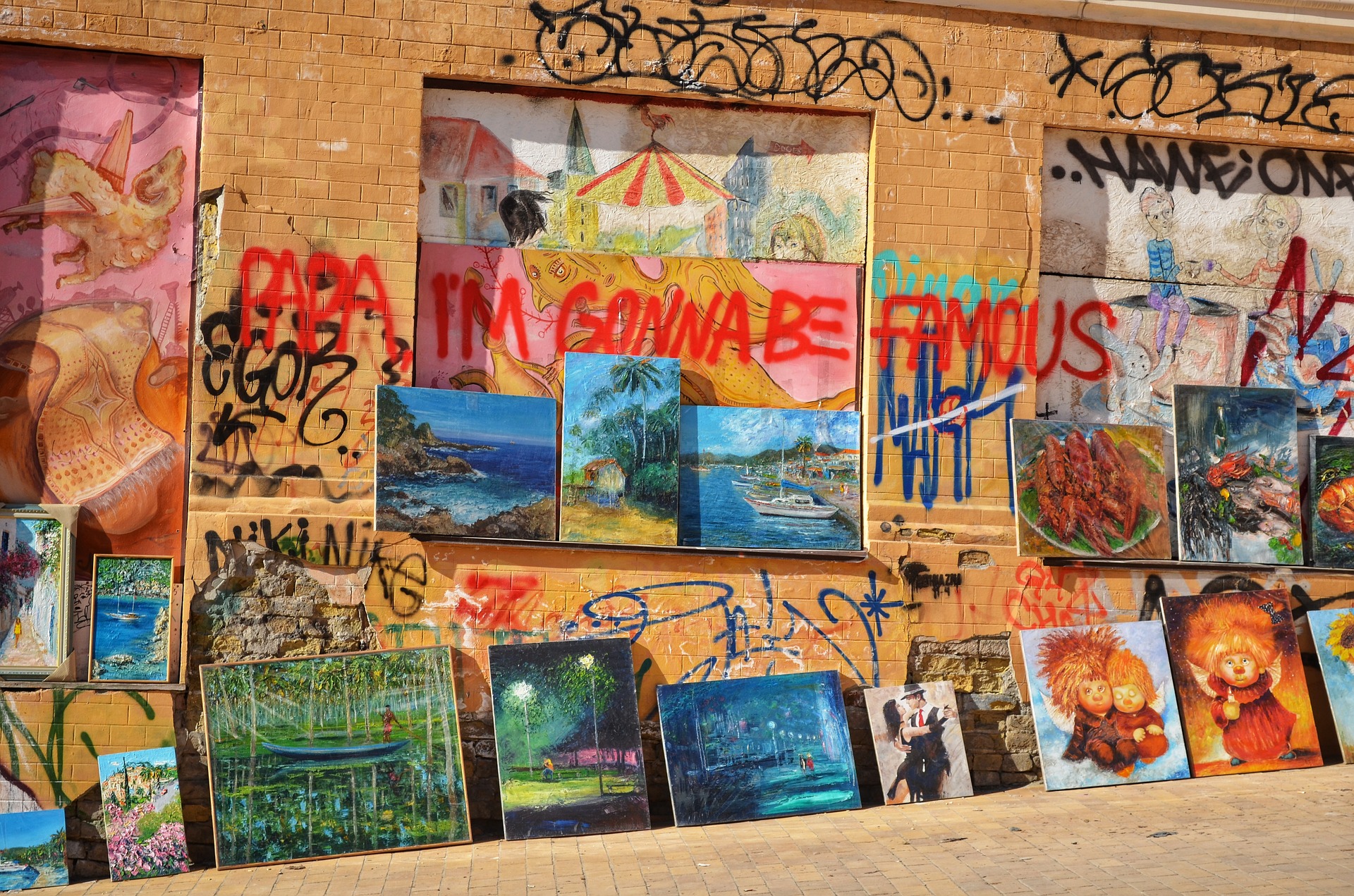

Up until recently, digital assets were hard to be owned and transferred between various platforms. If you own, for example, a car in the game GTA, you couldn’t sell it on eBay. Digital assets in the art world were hard to be traced and assigned ownership. Moreover, in order to profit off them, artists should have sold a large amount of copies at a very low price.

Blockchain has changed the way digital assets are owned and traded. The technology allows creators to verify the uniqueness of an item and prove the ownership of a certain artwork. Moreover, it greatly facilitates the digital assets trade. Now there are various platforms where any artist can register and “mint” their creations (this term represents the process of validating each artwork and recording it on the blockchain). NFT’s metadata contains unique properties and cannot be forged or altered. Thus, the blockchain technology is used to prove ownership and provenance.

A lot of people would argue that an NFT is not any different from an ordinary copy of a file but that is not true. If you buy a single edition of an NFT, you become the sole owner of this asset. Other people may download an image of this file from the Internet but they do not own it. Just like with physical art, you can have a reproduction of a painting but you do not own the original. Furthermore, artists usually provide the buyer with a high-resolution file of the asset or sometimes even the physical artwork.

Main characteristics of non-fungible tokens

NFTs are unique

Since digital items become NFTs by being minted, no two NFTs are alike, i.e., every item is one of a kind. Minting is the process of validating information and recording a new block containing that information on the blockchain. This way, it is not possible for two digital assets to have the same record on the blockchain since they do not have the same characteristics.

Moreover, NFTs are governed by smart contracts. A smart contract is in fact a self-executing agreement between two parties – they can be a seller and a buyer, that is directly written into lines of code. In addition, you cannot alter the smart contract post-factum because it is stored on the blockchain, which is a decentralized network. The code controls the execution of the contract and all the transactions are irreversible and traceable.

NFTs are tradeable

Due to the wider adoption of the technology, now artists can easily display their works on NFT marketplaces and benefit from their artwork. There are different selling options available on the platforms like creating collections or selling bundles, choosing a fixed price or putting the item up for auction.

Buyers can also resell the digital items they have bought and make a nice profit.

NFTs have liquidity

Since you can resell NFTs, you can invest in them and hold on to them until their price increases. Here is the tricky part, however. How do you know what NFTs you should buy and how you can be sure that their price will rise in time? Unless, you purchase NFTs from world famous artists, you can only guess. What is considered valuable is the artist’s brand, popularity, social media following as well as the story behind the piece.

Our advice is to buy art you like because you might be stuck with it forever.

Copyright

By default, artists retain the copyrights over their works. It is up to them to decide whether they are going to transfer them to the buyer. Artists can also receive a certain precent of royalties on future sales if they have chosen this as an option.

NFTs are collectable

NFTs can now be moved with ease across various platforms and ecosystems. When an artist publishes a new NFT, their project is tradeable on marketplaces and is visible even to users who do not own a crypto wallet. Digital assets in the form of non-fungible tokens can be even displayed in both physical and virtual galleries and museums.

NFTs follow standards

ERC standards allow creators to make transactions and list their NFTs on different platforms. They also govern ownership, trading and seamless transfer of NFTs across various platforms.

ERC standards and what they represent

Let’s first start with explaining what ERC is. It stands for Ethereum Request for Comments. It defines how tokens can be shared, exchanged and transferred on the blockchain. There are various types of ERC standards, but only two are currently used for NFTs: ERC-721 and ERC 1155.

ERC-721 was the first standard built to record non-fungible digital assets in 2017. It requires a new smart contract to be deployed for each new class of tokens. It is limited only to non-fungibles. It has an extension ERC-998 that allows for non-fungible tokens to own other non-fungible tokens and ERC-20 tokens (i.e., fungible tokens). In other words, it composes fungible ERC-20 tokens and non-fungible ERC-721 tokens into sets and hierarchies.

Since the first version of ERC-1155 was published in June 2018, it has been widely adopted as being much more flexible that ERC-721. Unlike ERC-721, this new standard allows for multiple tokens (actually, an infinite number of tokens) to be governed by a single smart contract. With ERC-1155, multiple tokens can be sent in one transaction, thus saving time and costs. Furthermore, it allows for both fungible and non-fungible items to be included in the same contract. Its use can also be extended to new concepts like semi-fungibility.

As you can see, the NFT space and the technology behind it develop with lightning speed. If you missed buying Bitcoins at $1 in 2011, don’t make the same mistake. Start your NFT journey now.

If you need any help with NFTs, contact us using the form below.